Exchange rates, heavy transfer fees, and other unexpected costs can significantly lower the payment when you pay freelancers overseas. Even if you offer to cover the extra fees, the amounts add up, incurring unnecessary spendings. Not to mention there’s loads of compliance issues you need to keep up with to prevent potential penalties.

But these challenges shouldn’t keep you from hiring top freelancers overseas.

If you’re planning to work with international freelancers, we’ll take you through all the steps you need to define currencies and payment methods and see how a freelancer’s location can impact your collaboration.

Let’s get to our guide on how to pay freelancers overseas!

This post is part of our guide on how to pay contractors.

5 crucial steps when paying freelancers overseas

#1 Agree on the payment terms and legal jurisdiction

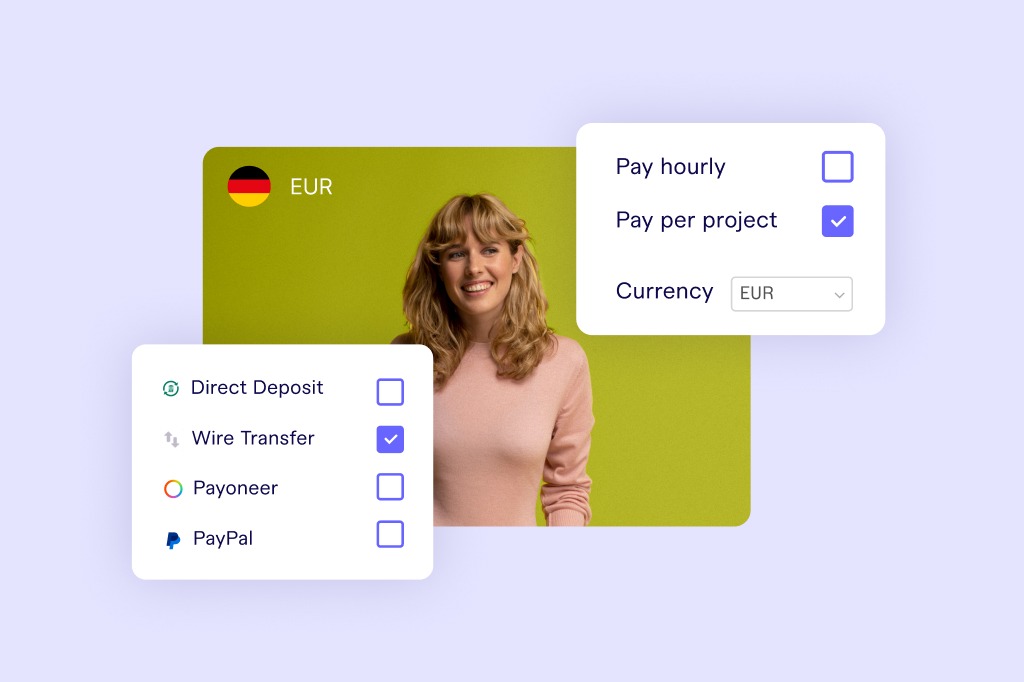

Most freelancers have their own preferred rate type, whether that’s hourly, fixed per project, or more specific like per word for content writers and editors. Before you even decide to work with a contractor, you need to clarify how you want the compensation to be calculated at the end of the project. You should also define the payment milestones, as some freelancers may ask to be paid upfront or before the final deliverable is submitted. This is true for all freelancers and contractors.

Next up is defining the currency. Some contractors outside of the US have USD accounts but for the others, you’ll need to see if they’re able to accept the currency rate fees or if they expect you to carry the charge. You should also define the payment method as the cost can vary from 30 cents up to $50 per transfer.

Although putting all of the above conditions into writing will significantly reduce your risk of disputes with overseas freelancers, it is still advisable to agree on a legal jurisdiction. A jurisdiction clause can be defined as ‘exclusive’, which means only the specified country’s courts can hear the case or ‘non-exclusive’, which means that the parties can also litigate in other courts. Initiating a legal process in a foreign country is far more complicated and requires a lot of resources than initiating the same process in your own country.

A different option is including an arbitration clause. Arbitration is a form of Alternative Dispute Resolution (ADR) which can help to resolve a commercial dispute without the need for litigation, thereby avoiding going to court and tackling the ensuing jurisdictional or governing law issues altogether.

Once you’ve established the payment terms and legal jurisdiction, be sure to mark it through a Master Service Agreement or a contract agreement so no misunderstandings may occur. At this point, you’ll want to gradually start going through a contractor onboarding checklist to ensure all legal and administrative matters are prepared.

#2 Ensure tax compliance

As a general rule, you’ll want to sign a contract with every new contractor to clarify compensation, deadlines, how payments will be made, tax liability, and other general provisions and agreements. This keeps your company and its information safe in case of a dispute or data breach disclosure.

Now let’s face the elephant in the room: taxes.

A U.S. company doesn’t need to pay, withhold, or report taxes for international freelancers living outside of the U.S. This is true for all other countries as well.

However, it’s up to the company to ensure that the work is not performed by a foreign citizen from within the country. In the latter case, there are extra policies and taxes that apply.

U.S. companies need to collect a W-8BEN form from all foreign contractors living and performing work from outside of the U.S. The W-8 BEN-E applies instead if the contractor is working and receiving the payment through their own entity (i.e. company, agency, etc.). This form will include ITIN (International Taxpayer Identification Number) and other general information that will help your company to confirm the freelancer is not working from within the U.S. Be sure to collect these forms before you start working with a contractor since you will not be able to pay them before they submit it.

If they fail to provide the completed form, you’ll have to deduce approximately 30% withholding rate on their payment. The exact terms and withholding rates will be determined based on your contractor’s country signed tax treaty with the U.S.

You do not need to submit 1099-NEC for your foreign freelancers, but you are obligated to provide them with the information so they can submit the data to their tax authorities. Therefore, you need to ensure you keep an accurate documentation of all funds paid during the year.

In addition, it’s your duty to ensure that you’re compliant with the labor laws in your freelancer’s country even when your company lies in a different jurisdiction. It’s the contractor’s location that counts when it comes to law forcing a contract, labor hours, payment frequency, and more.

#3 Choose the right payment method

Wire transfer is the most popular solution since it’s the most secure one, it covers all countries, and fits all use cases.

The catch is that it can get very expensive at anywhere from $25-$50 per transfer. There’s also the risk of high currency conversion fees and sometimes the bank of your foreign contractor will have an additional fee. Freelancers could either request reimbursement for this or take a loss.

When doing bank transfers, make sure to get all bank details right through the invoice. Besides the bank address you’ll need:

- A transit number for freelancers in Canada

- The IBAN and BIC/Swift code for your European contractors

- A BIC/Swift code, BSB, and account number for Australia

- The bank’s state branch and code when working with Indian freelancers overseas

However, there are plenty of wire transfer alternatives to use when you pay freelancers overseas. PayPal, Payoneer, Wise [formerly known as Transferwise], or any other online payment platforms are great solutions, but they don’t fit everyone. PayPal, for instance, doesn’t cover all countries and has crazy exchange rates. Payoneer demands opening an account and has a fixed annual fee, plus extra fees/transfer and during currency exchange.

The contractor you’ll work with most definitely has their own preferred payment method as speed and reliability of the service vary from option to option. Find out which one this is before you give the first assignment and accommodate their needs for a smooth collaboration.

#4 Freelance marketplaces and management systems

Another option that reduces the need to deal with tax compliance and payment methods is using freelance marketplaces like Fiverr, 99designs, or Upwork etc. These platforms will take care of payments, tax compliance and even serve as the arbitrator in case of a dispute. The main problem is that they charge an extra 15%-20% which will make top freelancers hesitant to work with you. This means you won’t be able to work with every contractor you want through these platforms.

Another solution is using a freelance management systems (FMS), like Fiverr Enterprise, which will also take care of the payments and the tax documentation aspect, but without taking any extra fee from your freelancers so you can work with any freelance including freelancers you sources yourself.

#5 Do a KYC/AML before making your first payment

Another point companies often skip when paying contractors abroad is the need to do a Know Your Client (KYC) check before sending the money. This ensures you won’t be paying someone whose account is associated with criminal behavior and it applies to many businesses as part of the AML (Anti Money Laundering) regulation.

If you opt to pay freelancers internationally through a wire transfer, the bank will check everything so you’ve got one hurdle out of the way. Online payment solutions, like Payoneer, and freelance marketplaces, like Upwork, will take care of these themselves. But if you opt for a check, credit card, or other similar payment, you’ll need to get your legal team on board to set up an analysis procedure for this.

Pay freelancers overseas fearlessly

Starting to work with freelancers overseas can provide you with many benefits from more talent options to lower costs. There’s no reason for companies to avoid working with foreign freelancers and contractors as long as they stick to the rules above. Following these above suggestions will help you minimize risk while maximizing your productivity.