The best way to make sure that you have available talent to meet incoming client needs is to work with independent contractors and freelancers on a per-project basis. They often have niche skills, are available to work quickly, and won’t cost you in overheads when the project is over. To become your freelancers’ preferred business to work with, one critical consideration is making sure they get paid accurately and on time.

Fiverr Enterprise is a Freelancer Management System (FMS) that allows you to pay a single invoice each month, and ensures every contractor is paid according to their own terms.

Keep reading to learn all about your options for creating a contractor payment schedule, and some best practices to boot!

What Is a Contractor Payment Schedule?

A contractor payment schedule is the way you compensate your freelancers and independent contractors for the work which they complete. Unlike employees, who tend to be paid at the end of the month or on a specific date, freelancers may have their own expectations for how they are given the money they are owed, which can vary from one freelancer to the next. Setting up a contractor payment schedule allows you to streamline your own processes, so that you aren’t making every day pay day for your business.

Common Payment Schedule Models

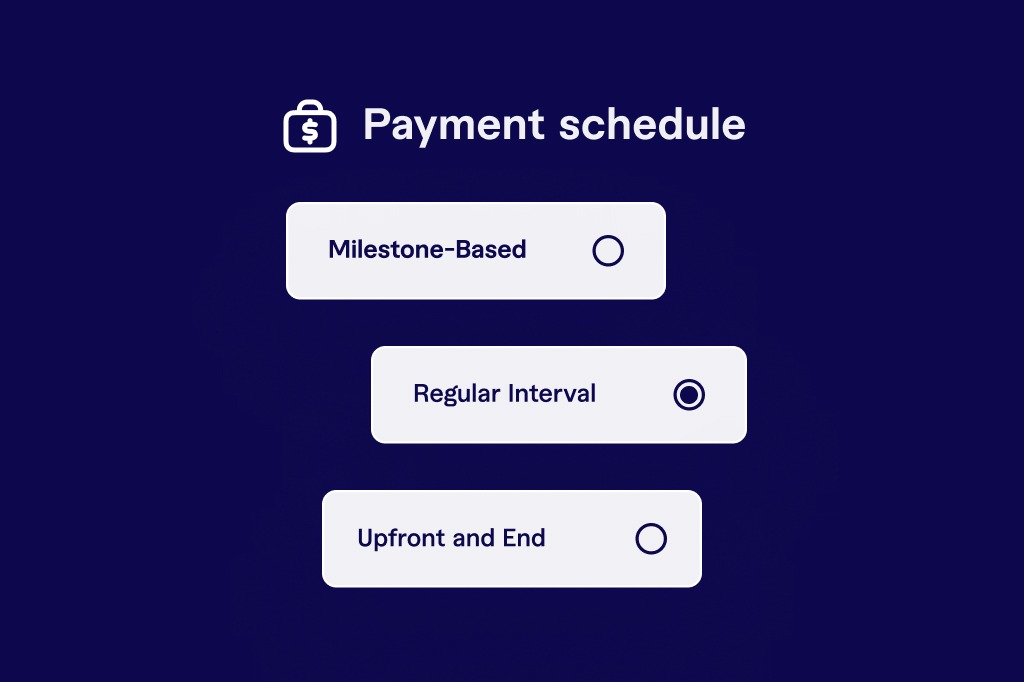

Most freelancers use one of three payment schedule models to ensure they are paid according to their needs. These are:

Milestone-based payments: A milestone can relate to a specific juncture in a task or project, such as an MVP of a new feature or tool, or a project or task completion. Freelancers may break down an entire project into smaller milestones so that they are not left with undue risk while they complete an agreement.

Regular interval payments: In this situation, freelancers are paid at a regular cadence, much like employees. However, you will need to decide if payments will be split equally, or based on work performed. What will happen if the scope of the project increases, or if work is completed more quickly than assumed?

Upfront and end payments: Some freelancers prefer a deposit at the start of a project, and the remainder of their fee paid on completion. This can work particularly well for a very short-term project. The business carries some risk as they pay a certain percentage up front, before any work has been completed.

Whichever model you choose, there are factors to consider. Some freelancers will require a percentage payment up front, and this may not be possible with your current finance set up. It may be easier to get a PO completed, and pay a full amount for a project ahead of time like any other supplier. Remember, each freelancer may have their own needs, invoice in a different format, or expect a specific currency or deadline to be met.

Best Practices for Managing Payment Schedules

Whatever your process for building a contractor payment schedule, here are some top tips:

- Communicate openly: The most important thing is that all your freelancers have a complete understanding of your terms. They may be willing to be flexible, but if they send an invoice that they expect to be paid immediately, and end up needing to wait 60 days or more — you’re not going to be on their next Christmas card list.

- Keep detailed records: Make sure you know where to find all agreements, and information on payments that have been made, alongside which freelancer they relate to. An invoice number helps with easy checks and balances, and track any changes you or the independent contractor makes to payment terms moving forward.

- Where possible, automate! Once freelancers have become part of your regular talent pool, their payment information and preferences should be in the system, and ready for you to approve milestones at a regular cadence. Set up reminders if you’re expecting an invoice, so that you can stay one step ahead.

- Consider a process for disputes: Payment disputes are bound to arise, and you’re better prepared if you have clear procedures in place. Who is responsible for deciding which way to approve or deny a dispute, and managing that budget for your team?

- Leverage the right software and tools: Think about technology for both tracking and managing payments and workload. With the right SaaS platform at your fingertips, you can quickly look up outstanding work, milestones ready to approve, payments in process, and payments received, so that you can answer questions and stay on top of workflow.

Utilizing Fiverr Enterprise to Build a Contractor Payment Schedule That Works for All

Fiverr Enterprise is a SaaS solution that gives you full visibility and control over your entire freelance workforce by allowing you to source, hire, onboard, manage and pay, all while ensuring compliance, so your teams can work faster and maximize business growth.

When it comes to payments, Fiverr Enterprise consolidates every freelancer invoice into a single global invoice that you can pay directly. You never have to organize multiple vendor contracts, juggle different currency conversions, or think about varied payment terms. Instead, across 190 countries, in 80 currencies, and through seven different methods, your freelancers are paid according to their preferred terms at agreed-upon milestones.

At the back end, you get detailed and customized cost breakdowns by department, cost center, hiring manager and more so you can rapidly execute payments — without the administrative burden.

If you’d like a walkthrough of how to efficiently and accurately pay independent contractors, as well as manage their workload, and source and hire talent with ease, schedule a 30-minute call with one of our team.