Global payroll providers are specialized entities that offer payroll services across multiple countries. They handle the complexities of managing payroll for employees spread out over various jurisdictions, each with its own set of regulations, currencies, and tax systems.

By leveraging their expertise and technology, these providers simplify the payroll process for organizations operating internationally, ensuring the compliance and accuracy of transactions.

These providers use advanced software platforms to automate and manage the payroll function.

This includes calculating wages, tax withholdings, and benefits; complying with local labor laws; processing payments in multiple currencies; and providing detailed reporting. Their services are crucial for multinational companies looking to optimize their global workforce management while minimizing operational risks associated with international labor laws and financial regulations.

Key Features of Global Payroll Providers

A global payroll provider should offer the following capabilities:

- Multi-country compliance: Ensures that companies adhere to the varied and complex labor laws, tax regulations, and reporting requirements across different countries. This involves staying updated with the constantly changing legal landscapes in each jurisdiction and applying these updates to the payroll process.

- Currency and exchange management: Addresses the challenges of dealing with multiple currencies across different countries. This ensures that employees are paid accurately in their local currency, factoring in the fluctuating exchange rates. By automating the conversion process, payroll providers eliminate errors and reduce the time spent on manual calculations.

- Consolidated reporting: Simplifies the management and analysis of payroll data across multiple countries. It aggregates all payroll-related information into a single, comprehensive report, providing a clear overview of global payroll activities.

- Payroll automation: Automates repetitive tasks such as data entry, calculations, and the distribution of payslips, reducing the scope for human error and freeing up valuable time for HR professionals. Automation ensures that employees are paid correctly and on time, across any number of countries, while adhering to the respective local regulations without requiring manual oversight for each transaction.

- Tax filing assistance: Aids organizations in accurately calculating, reporting, and submitting employee taxes to the appropriate local authorities. This includes keeping companies updated on changes in tax laws that could affect their operations. It helps ensure compliance with country-specific tax laws and regulations.

Notable Global Payroll Providers

1. Fiverr Enterprise

Fiverr Enterprise is a freelance management system (FMS) that enables businesses and companies to source, hire, onboard, manage and pay their entire freelance workforce while ensuring compliance.

Fiverr Enterprise is a robust solution for any enterprise. Here are 5 best practices to follow that can streamline the process of freelancer global payroll from end to end.

1. Understand your legal and regulatory requirements

Misclassification means different things in different countries. If you misclassify a worker as a freelancer, you could be liable for steep fines and heavy penalties. You need to make sure you have the right contracts and documentation signed, and that your agreement is totally above board.

2. Choose the right partner

Global payroll should be something that runs in the background without too much effort on the part of your teams. Choose a partner with a proven track record in the business, who understands freelancers and the different ways in which they work, and can accommodate with flexibility..

3. Integrate with HR and Finance systems

With smart integrations, you should be able to connect all freelance spend to a purchase order, invoice, and cost center. Make sure you have various ways to pay global talent, whether that’s by hour, project, or milestone. Fiverr Enterprise allows for one click payment of all freelancers, across 190 countries and 80 currencies.

4. Establish KPIs for payroll processes

Want to be sure payroll is running smoothly? Make sure you have Key Performance Indicators in place to report on your payroll processes. Track planned vs actual spend, monitor missed payments and compliance risk, and easily show the value of your solution to the C-suite.

5. Stay on top of emerging technology trends

If you’re still managing freelancer payroll manually as a time-consuming add-on to your “normal” payroll, you’re missing a trick. Fiverr Enterprise helps you put a stop to chasing invoices, endless payment negotiations, or sifting through spreadsheets, and allows you to automate and streamline global payroll for freelance talent.

2. Rippling

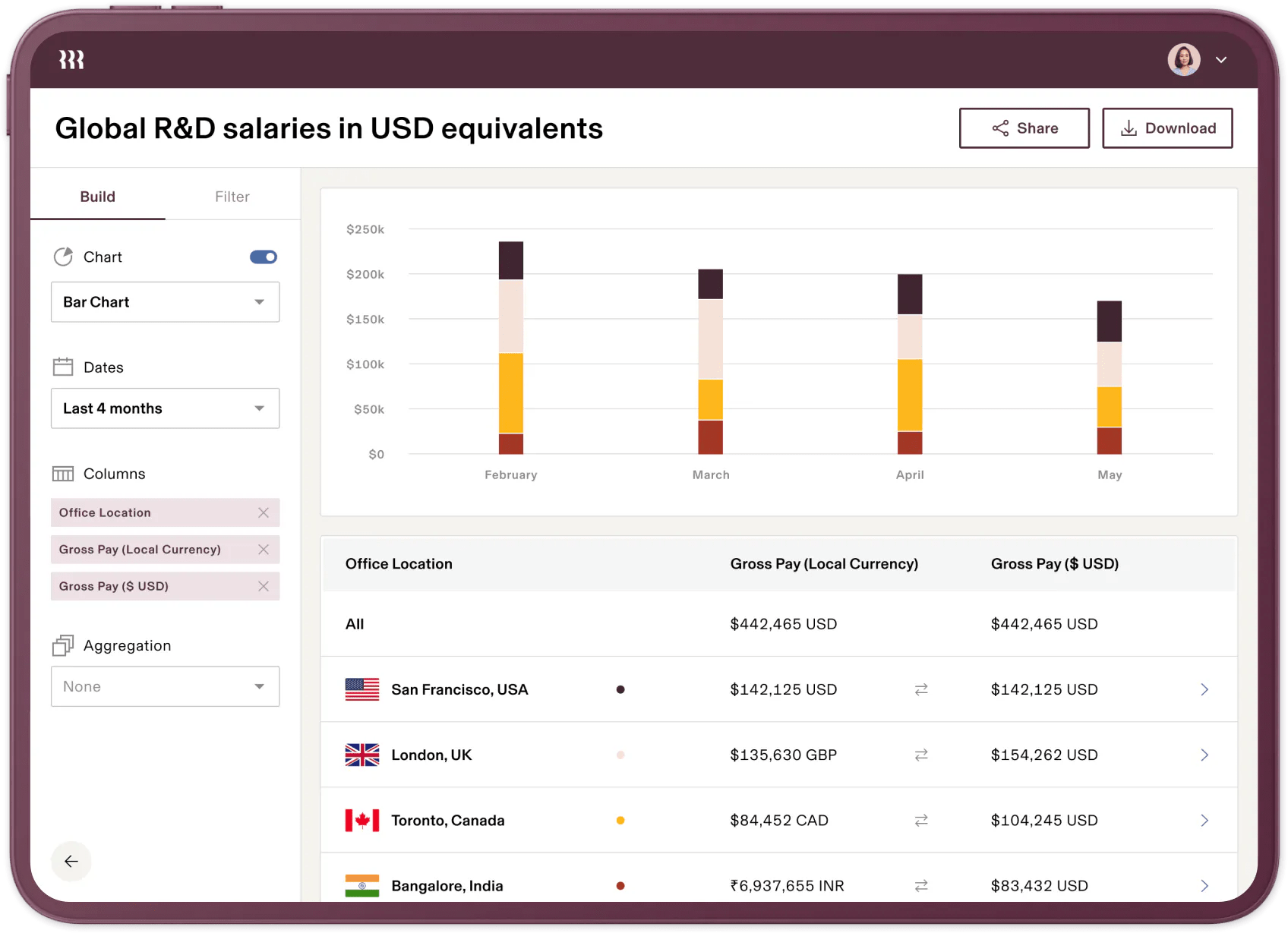

Rippling offers a solution for managing global teams by simplifying complex processes such as local compliance, currency conversion, and the integration of HR, IT, and finance systems. Their platform enables companies to onboard, pay, and manage employees worldwide.

Key features:

- Onboard employees globally in 90 seconds: Allows companies to set up new hires with everything from devices to training, regardless of their location.

- Pay in local currency: Organizations can pay employees and contractors around the world in their local currency without delays associated with bank transfers or currency conversion.

- Unified management system: Combines HR, IT, and finance systems into one unified platform. This eradication of data silos reduces redundant work and enhances operational efficiency across global teams.

- Automated global compliance: Automates the compliance process by keeping up with local laws abroad, reducing the burden of understanding and complying with complex international regulations.

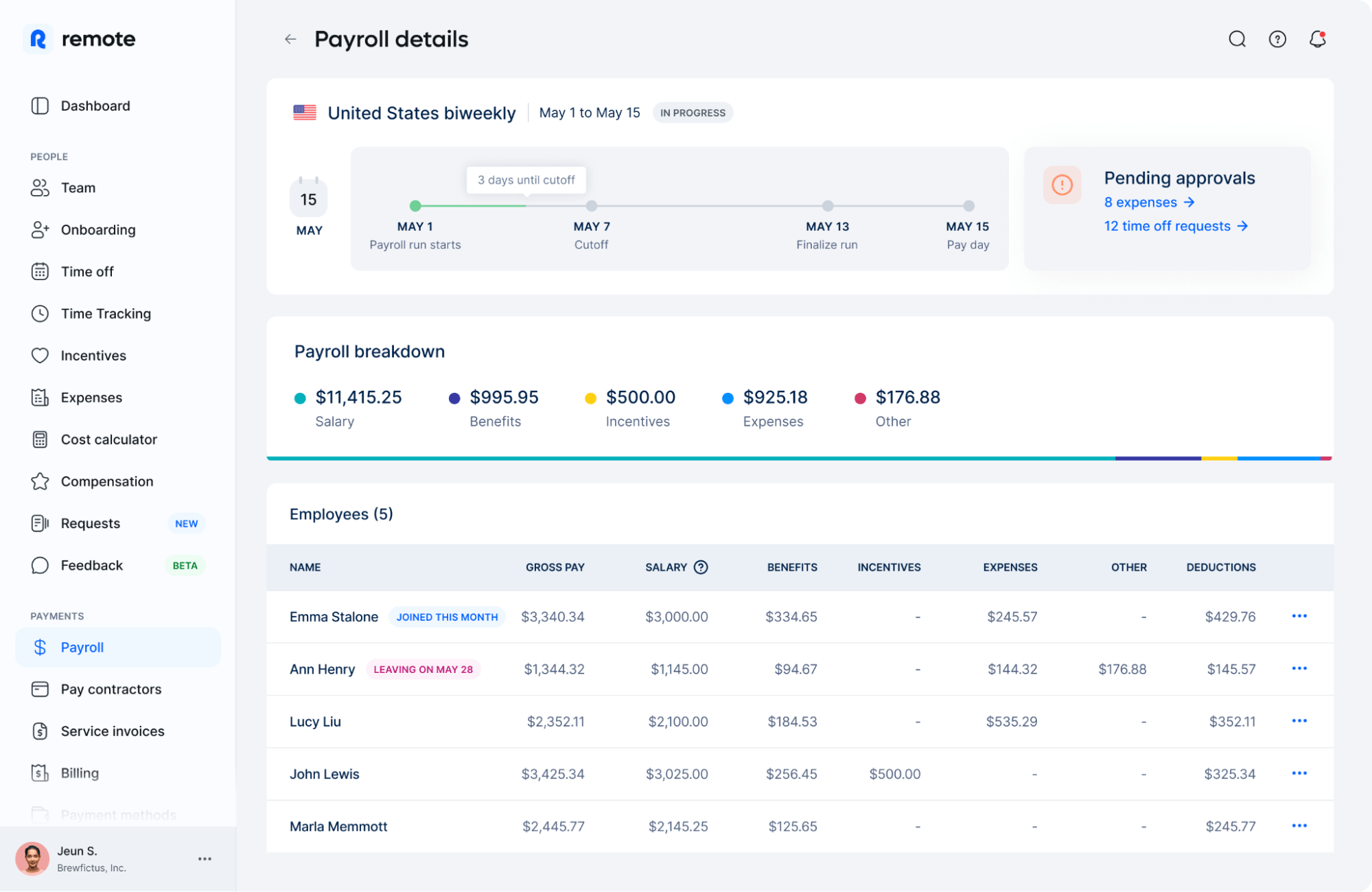

3. Remote

Remote offers a global HR solution that simplifies the management of payroll, benefits, and compliance by consolidating these functions into a single platform. It is designed to support the growth of teams, ensuring efficient operation across borders without the complexity typically associated with international HR management.

Key features:

- Rapid onboarding and payroll setup: Enables quick setup for payroll and onboarding processes, integrating transformative salary tools and real-time data collection.

- Local compliance: With in-country experts on labor laws, ensures that international hiring and payments are compliant.

- Simplified HR workflow: By handling payroll, managing benefits, and accessing documents from an integrated hub, Remote simplifies HR workflows.

- One invoice for multiple countries: Simplifies billing for organizations with teams in different countries through a single invoice system.

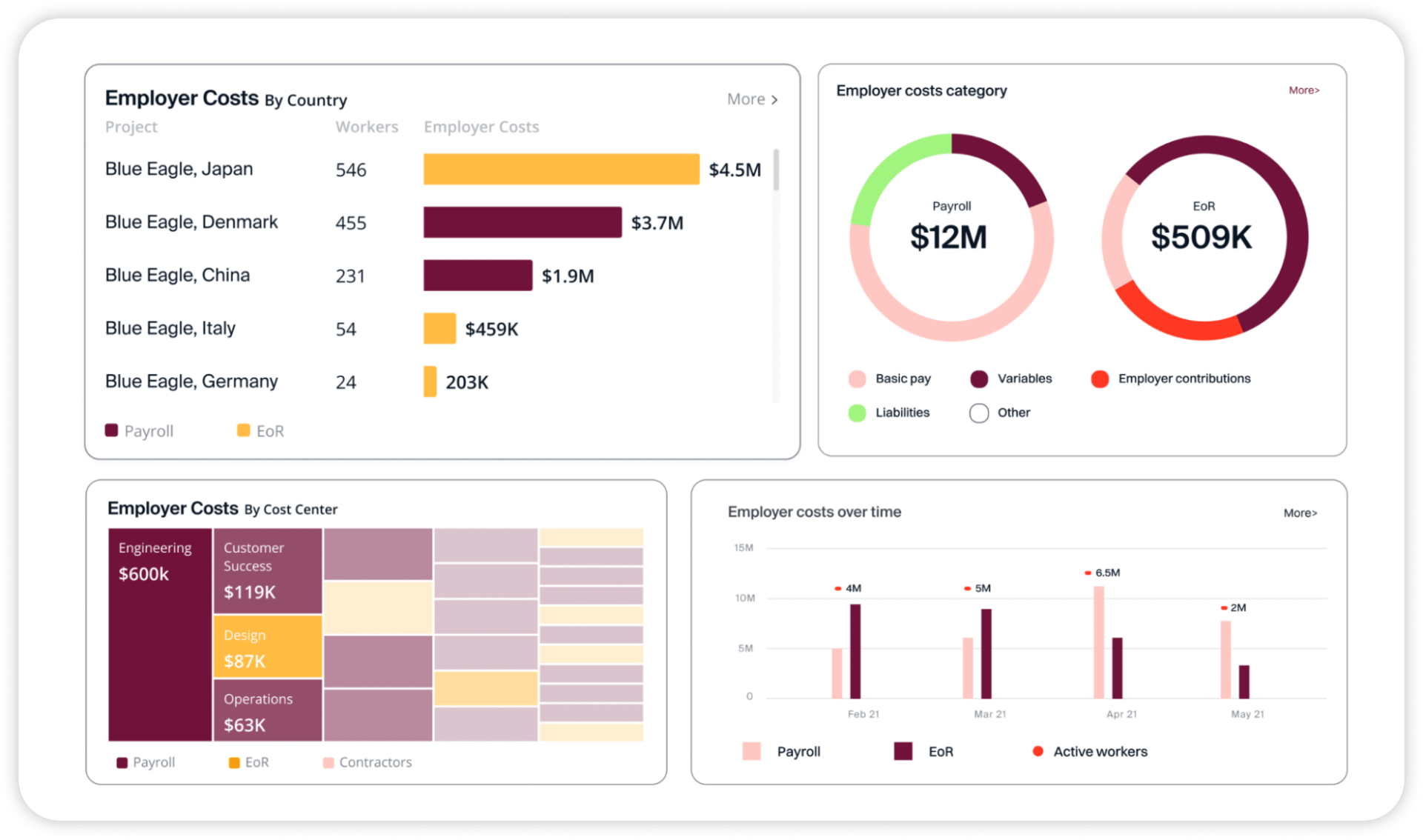

4. Papaya Global

Papaya Global offers a platform that automates the payroll process, handling everything from employee payments to regulatory compliance across multiple countries. It aims to simplify global workforce management, allowing organizations to focus on their core operations while maintaining compliance with local laws and regulations.

Key features:

- Automated global workforce payments: Ensures on-time, regulated, automated payments to employees worldwide, minimizing fees and competitive foreign exchange rates.

- Full local compliance and liability: Guarantees compliance with local laws for payroll processing and assumes full liability for the funds, payment processes, and execution.

- Quick onboarding: Allows companies to quickly integrate their payroll and financial data with Papaya’s connector, accelerating the payment process for global employees.

- Regulated with bank-level security: A regulated fintech company leveraging J.P. Morgan payment rails for secure transactions. It offers complete visibility of the payment process with segregated funds ensuring security.

5. Multiplier

Multiplier offers a solution for managing global payroll, ensuring accuracy, compliance, and efficiency. The platform simplifies the complexities of international payroll processing, allowing organizations to pay employees across different countries without needing multiple providers. By automating critical payroll functions and adhering to local regulations, Multiplier helps companies save costs and reduce administrative burdens.

Key features:

- Zero-error multi-country payroll: Processes payroll across various countries, eliminating the need for multiple providers and reducing errors.

- Salary calculator: Provides accurate breakdowns of CTC for employers with simple tools, enabling salary calculations and budget planning.

- Competitive benefits: Offers competitive benefits and cost-effective insurance coverages compliant with international standards, enhancing employee satisfaction.

- Self-service platform: Enables management of reimbursements, viewing of payslips, tracking expenses, and offering benefits through an integrated platform.

6. Gusto

Gusto offers a solution for remote teams, handling the process of hiring, onboarding, paying, and managing employees across the globe. The platform is designed to grow with the organization, ensuring that tools scale accordingly. It aims to help businesses navigate the complexities of global operations with ease, allowing them to manage a distributed workforce.

Key features:

- Automated payroll processing: Simplifies payroll with features like automated deductions, direct deposit, and tax filing. This ensures employees are paid accurately and on time, regardless of their location.

- Employee benefits: Offers a range of benefits including health insurance, retirement savings plans (401(k)), and more.

- Time and attendance tracking: Provides tools for tracking employee hours and managing time-off requests.

- Fast hiring and onboarding: Empowers companies to hire remotely through services like offer letters, checklists for new hires, and software setup assistance.

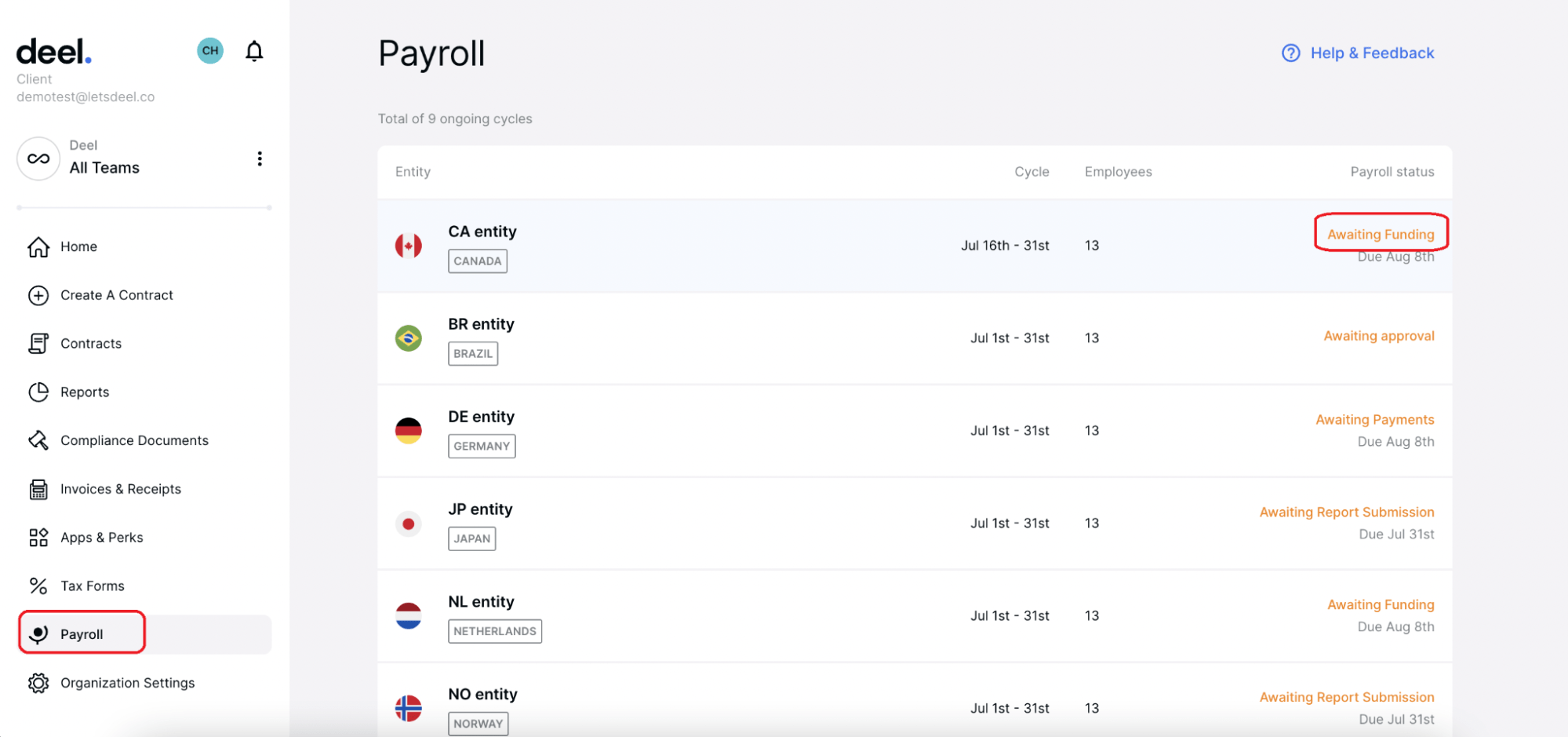

7. Deel

Deel offers a global payroll solution designed to ensure the seamless payment of direct employees, EOR (Employer of Record), and contractors across the globe. It simplifies international team management by consolidating payroll and compliance processes into one platform, supported by 24/7 customer service.

Key features:

- Compliance: Ensures full compliance with local laws in over 100 countries, reducing the risk of penalties and fines associated with international employment and payroll.

- 24/7 support: Offers round-the-clock customer support to resolve issues promptly.

- Unified platform for payroll and HR: Integrates payroll with HR functions such as visa support, PTO management, and expense handling, making global workforce management more efficient.

- End-to-end data accuracy: Minimizes errors through a unified process for managing employee data across different countries, enhancing reliability in payroll execution.

8. Payslip

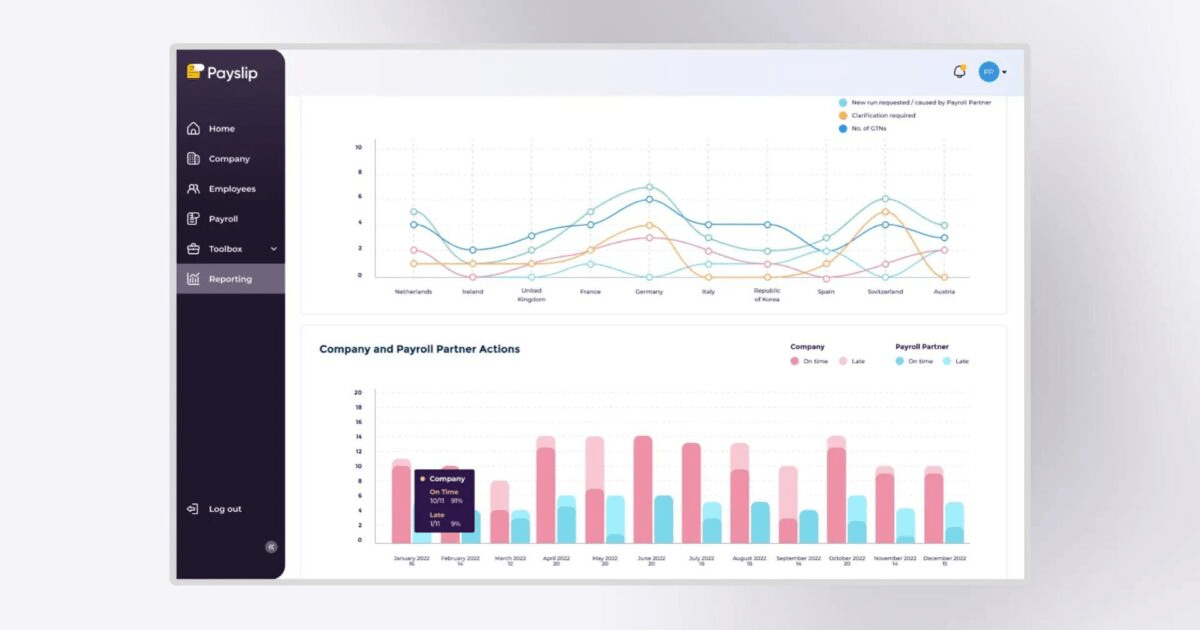

Payslip provides an AI-powered global payroll management solution that simplifies the payroll process for multinational companies. By digitizing and automating multi-country payroll operations, it offers time and cost savings, helping address the challenges of managing global payroll systems.

Key features:

- Automation of end-to-end processes: Eliminates manual work and spreadsheets by automating end-to-end processes. This reduces errors and saves time.

- Integration as a service: Offers seamless integration with various sources for basic payroll data flows. A single cloud platform connects the entire global payroll ecosystem.

- Real-time payroll data insights: Provides actionable insights through its reporting and analytics features.

- Global vendor management: Allows businesses to connect with and manage their payroll vendors on one platform.

9. Oyster HR

Oyster HR offers a comprehensive global payroll solution designed to streamline the process of paying team members across different countries. Utilizing a single platform, Oyster HR ensures accurate and compliant payments while automating invoices and reimbursements. This approach simplifies global payroll operations, making it easier for businesses to manage their international workforce efficiently.

Key features:

- Pay full-time employees: Supports the payment of full-time employees across more than 130 countries.

- Settle invoices for contractors: Supports the settlement of invoices and payments to contractors in over 180 countries, offering flexibility in managing diverse global teams.

- Direct employee payments in selected countries: For companies with direct employees in Spain, Canada, and the UK (with more countries coming soon), provides specialized payroll services tailored to local requirements.

- Simplified global payroll workflows: Offers simple workflows for approving and delivering on-time multi-currency payments, using local intelligence to maintain compliance.

10. ADP GlobalView Payroll

ADP GlobalView Payroll offers a solution for managing global payroll needs, designed to support businesses of all sizes in navigating the complexities of international payroll processes. It provides a unified platform that simplifies payroll operations across multiple countries, ensuring compliance with local tax laws and regulations while offering scalable services.

Key features:

- Simple global payroll processes: Simplifies complex multinational payroll tasks through automation and integration with HR systems.

- Compliance expertise across borders: With deep knowledge of local regulations, ADP ensures that organizations stay compliant with tax laws and employment legislation in each country they operate in, minimizing legal risks.

- Reporting capabilities: Offers detailed reporting tools that provide insights into payroll operations globally.

- Employee self-service portal: Includes a self-service portal where employees can access their pay slips, tax documents, and personal information securely online, enhancing transparency and engagement.

Conclusion

Managing a global workforce involves navigating complex challenges, including local compliance, payroll processing, and integration of HR, IT, and finance systems. Effective global payroll solutions simplify these processes, providing automation, compliance assurance, and seamless integration. By leveraging these platforms, organizations can enhance operational efficiency, reduce administrative burdens, and focus on strategic growth.