Employee misclassification poses a serious risk for companies.

The practice of hiring individuals as independent contractors while they perform the duties of a full-time employee is illegal, and what many companies misunderstand is that it’s up to the company to define who’s an employee and who’s a freelancer.

In 2020, 59 million Americans considered themselves freelancers; that’s 36% of the U.S. workforce. That number is expected to surpass 90 million by 2025.

This has attracted the attention of both the legal and tax systems. The difference in the legal obligations whether a company classifies a worker as either an employee or independent contractor is significant, particularly in terms of worker protections and tax revenue. Therefore, governments, both state and federal, have been taking a hard look at how companies are classifying their workers.

Unfortunately, the result of this increased government involvement has created a complex patchwork of evolving laws on how to classify a worker – and an increasingly aggressive framework of penalties for employee misclassification.

The legal and business consequences for a company that misclassified workers as independent contractors when the government or the tax authorities considers them to be employees can be costly to the tune of millions owed and a damaged reputation.

This is part of an extensive series of guides about compliance management.

What is employee misclassification?

Classifying each worker is a legal decision that defines the legal relationship between the company and the worker. Classification impacts everything from what taxes are owed to how the worker delivers services.

When companies decide to classify a worker as an independent contractor, they are responsible for ensuring that the worker is qualified as an independent contractor according to applicable federal, state, and local laws. Worker misclassification occurs when a company classifies a worker as an independent contractor, while the federal, state or local law consider them as an employee.

Why do the governments care?

The federal and state governments regulate many areas of the employer-employee relationship. Thus, they are concerned about worker misclassification because it defines people outside the regulated work relationship. Four reasons why they take employee misclassification seriously:

#1 Serious Loss of Public Revenue

Employers pay payroll taxes for each employee. Payroll taxes include Social Security, Medicare, and federal income tax withholdings. When an organization misclassifies an employee, it doesn’t pay these taxes for that worker.

The government may also lose out on tax revenue when the worker files their individual income taxes. Independent contractors can make business expense deductions that employees cannot.

They’re also required to contribute to funds like unemployment insurance and workers’ compensation. Misclassifying an employee results in employers not making their full contributions. Workers’ compensation insurance premiums are also determined based on employee count. Governments rely on this revenue to fund the social safety net and other public programs.

#2 Lax Legal Protections for Workers

Local, state, and the federal governments all pass legislation providing worker protections. Minimum wage laws, required sick and leave time, overtime restrictions are but a few. None of these laws apply to independent contractors.

Governments want as many people covered by these laws as possible as a matter of public policy. In contrast, contract law relies on the parties to negotiate for their interests. A negotiated relationship provides greater flexibility for the independent contractor, but also greater risk.

#3 No Social Benefits for Independent Contractors

Most Americans get their health care through work. Nearly all employers are required to offer health care to employees. Many contribute to employee retirement funds above compensation. Governments assert a public policy interest in ensuring everyone has health insurance and is preparing for retirement.

As companies compete for global talent, they also offer employees an increasing range of optional benefits. Benefits like student loan payments, wellness programs, and financial planning assistance. These benefits aren’t offered to independent contractors. The concern is that they are providing the same services to companies as employees, but on inferior terms.

#4 Level the Playing Field

Employees cost about 35% more than independent contractors. Their direct compensation may be comparable (this varies across industries and professions), but companies incur significant administrative and operations costs to manage employees.

All those laws that govern the employer-employee relationship come with a cost to the company, both monetary and in the flexibility they have to pivot with a changing market environment. Companies that work primarily with independent contractors don’t bear these costs or constraints, which provides them a competitive edge. Governments are concerned that some companies may leverage the fact that contractors are not as protected by law and will not pay contractors as they should.

The evolving legal landscape of employee misclassification

In 2020, there were 64.8 million independent contractors in the US. By 2027, that number is expected to hit 86.5 million, accounting more than 50% of the total US workforce.

This massive growth in independent contractors, and the realization that soon enough non-payroll workers will make up for the larger share of the workforce has attracted the attention of the legal and tax systems.

Their main focus of the state and the federal government legislation is surrounding worker misclassification, both regarding how to classify workers and what the legal repercussions are for misclassification.

Unfortunately, in almost all cases the classification tests do not distinguish between white and blue collar workers, although there’s a significant difference for the two groups and one that needs more protection from the hiring companies.

Here are some of the state level legislation regarding worker classification in recent years:

New York: Establishing Protections for Freelance Workers Act

One of the first freelance focused acts legislated in recent years. The law enhances the protections for independent contractors, specifically the right to a written contract, timely payment within 14 days and protection from retaliation.

The law establishes penalties for violations of these rights, including statutory damages, double damages, injunctive relief, and attorney’s fees. The law also determines that if there is evidence of a practice of violations, the penalty can reach $25,000.

California: AB 5 and Prop 22

California passed the most stringent restrictions on who qualifies as an independent contractor. In 2018 the California legislature codified the worker classification test set out by the state’s supreme court. The state starts with the assumption that a worker is an employee unless it is shown otherwise using the “ABC” test (see section 5.2). Under the ABC test, only a worker providing services “outside the usual course of the hiring entity’s business” can be an independent contractor.

The bill (AB 5) contained other restrictions that made working as an independent contractor difficult. In response to criticism, the law was modified in 2020 (AB 2577) by creating exemptions to its application.

Criticism of California’s approach to worker classification persists, mainly due to a $200M paid campaign sponsored by Uber and Lyft. In November 2020, Californians voted to approve Prop 22, which excludes gig workers, like Uber drivers, from the AB 2577. A new bill (AB 25) has been introduced in the California legislature that would repeal the ABC test.

New Jersey: New Requirements and New Penalties

New Jersey is another state with new employee misclassification laws that went into effect in 2020. These address informing workers of the issue of worker misclassification.

Organizations must now post notices that inform workers that worker misclassification is prohibited. The notice, provided by the state’s department of labor, informs workers of the protections state laws provide for employees, the definitions of employee and independent contractor, remedies that exist if they’re misclassified and contact information where they can file a complaint if they believe they’ve been misclassified.

The new laws also allow workers to sue an organization for retaliating against them for filing a misclassification complaint or asking about employee misclassification.

How to classify employees?

As important as correctly classifying workers is – one would think there would be a clear test to make a determination. Unfortunately, there isn’t and properly classifying workers is hard.

First, there isn’t just one test. The test used by the IRS is not the same one used by the DOL under the Fair Labor Standards Act (FLSA). States each have their own worker classification tests too.

Second, none of the tests provide a bright line yes/no answer. They all weigh a variety of factors, a situation that lends itself to ambiguity and inconsistent application.

Third, many organizations try to manage classification decisions manually, which increases the risks of inconsistent decisions and overlooked factors. It also makes the decision process more expensive.

Below is an overview of the worker classification tests most widely used in the United States.

The “Right to Control” 20-Factor Test – Used by the IRS

The U.S. federal tax code uses a “right to control” test to determine whether there’s an employer-employee relationship. The principle here is to determine the organization’s scope of control over the worker. The more control, the more likely the worker is an employee. If the worker has a high degree of independence, they may be an independent contractor.

The IRS issued a list of 20 factors organizations should consider when determining whether it has the “right to control” a worker. It’s grouped the 20 factors under three categories:

- Behavioral: How much control does the organization controls have over where, when, and how the person works? Specific factors to consider include whether it’s setting work hours, requires reporting, provides instructions and training, and specifies order in which tasks are done.

- Financial: These factors look at whether the worker operates as a business. One factor is how the person gets paid; are they paid on a regular timeline or do they submit invoices periodically? Other factors include whether the organization provides equipment to the contractor and whether they provide similar services for other organizations or are dependent on the company financially.

- Type of Relationship: One factor here is if the organization provides the worker with employee benefits. Whether other employees are doing the same type of work and, even, how each party can end the relationship.

A full list of the 20 factors is available on the IRS website.

The “ABC” Test

The ABC test comes out of California. More than half the states use a version of the ABC test, but they aren’t all the same. Application of the test is complicated in that a state may not use the ABC test for all situations. For example, a state may use the ABC test to determine applicability of wage and hour laws, but not for unemployment insurance.

Even so, the ABC test is widespread and presents a high barrier to classifying someone as an independent contractor. Its three prongs are:

A. The worker is free from the control and direction of the hirer in connection with the performance of the work, both under the contract for the performance of the work and in fact.

B. The worker performs work that is outside the usual course of the hiring entity’s business.

C. The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

Item B is the prong that sets the barrier so high. Under California’s ABC test, all three prongs must be met to classify the worker as an independent contractor. Other states take a more expansive position, balancing the factors as a whole.

The “Economic Reality” Test – Used by the FLSA

The “Economic Reality” test asks the question whether the worker is economically dependent on the organization or whether they’re in business for themselves. The Department of Labor (DOL) specifies two “core factors” to be considered:

- The nature and degree of control over the work.

- The worker’s opportunity for profit or loss based on initiative and/or investment.

The DOL rule also provides additional factors to consider, especially if there’s no clear answer after determining the two core factors. The secondary factors are:

- The amount of skill required for the work.

- The degree of permanence of the working relationship between the worker and the potential employer.

- Whether the work is part of an integrated unit of production.

A copy of the published DOL rule can be found here.

The Risks of Worker Misclassification

The types of penalties available vary under each law, as does how a penalty is calculated. Penalties may be imposed as a per employee or per statement basis. It’s also common for penalties to be calculated as a percentage of compensation or benefits owed.

State and federal penalties generally fall into the following categories:

- Administrative fines and penalties for noncompliance

- Criminal penalties, including potential jail time, for intentional misclassification

- Paying back pay and benefits with interest

- Damages as part of a civil lawsuit, including punitive damages

For example, the IRS could impose administrative penalties on a company equal to the taxes it should have paid for the misclassified worker. If it’s found that the worker was underpaid under a state wage law or the FLSA, then the company may also owe back pay and benefits to the worker, which the worker may be able to sue in court to recover. In both cases, interest and late fees could also be applied.

Because each applicable law sets out its own available penalties and legal remedies, the total costs for misclassifying a worker can quickly compound.

Governments also seek to increase the reputational costs for companies that misclassify workers. The recent New Jersey misclassification laws allow its department of labor to publish the names of companies that have violated any state wage, benefit, or tax laws. The proposed federal Worker Flexibility and Small Business Protection Act would require companies to post publicly their level of compliance with labor laws. The law also provides severe penalties for not posting.

How to Stay Compliant

All companies are working with independent contractors on some level, regardless of their size, industry or type of business. However, too many are unaware of the fact they are leveraging independent contractors or the amount of contractors they are working with.

Most CFOs under-estimate the number of independent contractors by more than 70%.

These companies need to first strat with properly documenting all the independent contractors their company is working with. You can not manage what you do not know you have.

Only then can you start reviewing the relationship of your non-payroll workers and then define the right internal processes to prevent future issues (i.e. recruitment, onboarding, payment and compliance processes).

You can do it manually or leverage a freelance management system, like Fiverr Enterprise, to automatically and continuously audit all of your non-payroll workers.

Manual audits

The law demands companies to conduct an audit to all of their independent contractors every 6 months as working terms and conditions are flexible by definition and federal and state law may change.

#1 A list of all non-payroll workers

You first need to create a list of all non-payroll workers your company engages with like freelancers, independent contractors, consultants, gig workers etc. and their locations. The location of your contractors determines which test will be used to classify them as a contractor.

#2 Legal documents

Ensure all workers have signed a contract indicating compensation, working hours, expected deliverables and that the relationship between the contractor and the company is clearly defined.

#3 Legal audits

Beyond the different tests applicable in different states and countries to determine whether a worker should be classified as a worker or a contractor, there’s an additional challenge when it comes to worker classification.

The challenge is that the hiring managers, the ones who manage the independent contractor, are familiar with the details of the engagement (the control they have on the contractor’s schedule, the provided equipment, the level of expertise etc.) but they are not familiar with the labor law on the contractor’s state or country.

However, the legal counsel that can define how to properly classify the worker is not familiar with the details of the engagement.

This means that in order to classify your worker, your legal team will need to interview both the contractor and the hiring manager before defining the risk level.

Automated and continuous audits

Due to the complexity of worker classification, Fiverr Enterprise has developed an automated solution to track and identify relationships at risk to be defined as an employee-employer relationship. This is an automated and continuous process, therefore we are able to provide an early warning before there’s a risk of misclassification.

Our process consist of 3 stages:

#1 Basic Data Gathering

Fiverr Enterprise collects information on the independent contractor, and on the job, meaning the work requested by the company.

For every independent contractor that is invited by the company , Fiverr Enterprise collects basic information like location (country and state), and entity structure (1099 or S-Corp) to establish potential misclassification risk.

For every milestone (unit of work performed by a contractor) completed by the contractor, Fiverr Enterprise collects information such as, length of engagement, price structure (hourly or fixed), average hourly wage, number of hours per month etc.

Fiverr Enterprise continues to collect and analyze information for every payment cycle throughout the engagement to determine the risk of misclassification.

#2 AI Based Algorithm Screening

All these data points are aggregated and analyzed to establish whether there is any potential classification risk which will always be visible in the platform.

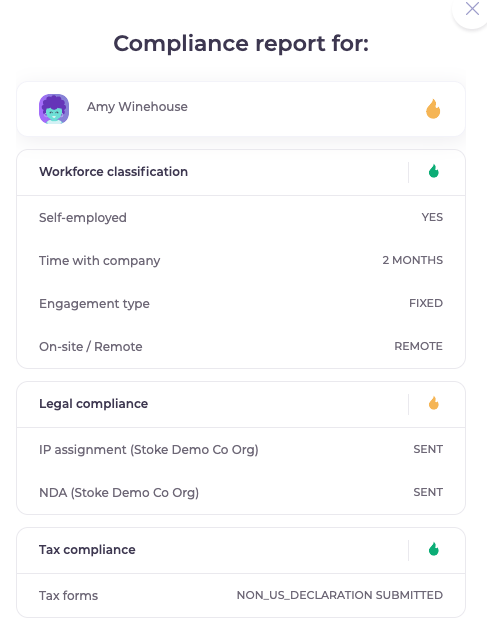

Risk level will be presented in real-time within Fiverr Enterprise UI for each contractor:

#3 Second Level Audit

If at any point throughout the engagement, the Workforce Classification Engine will establish that there is indeed a potential risk for misclassification, the platform will trigger a second level audit.

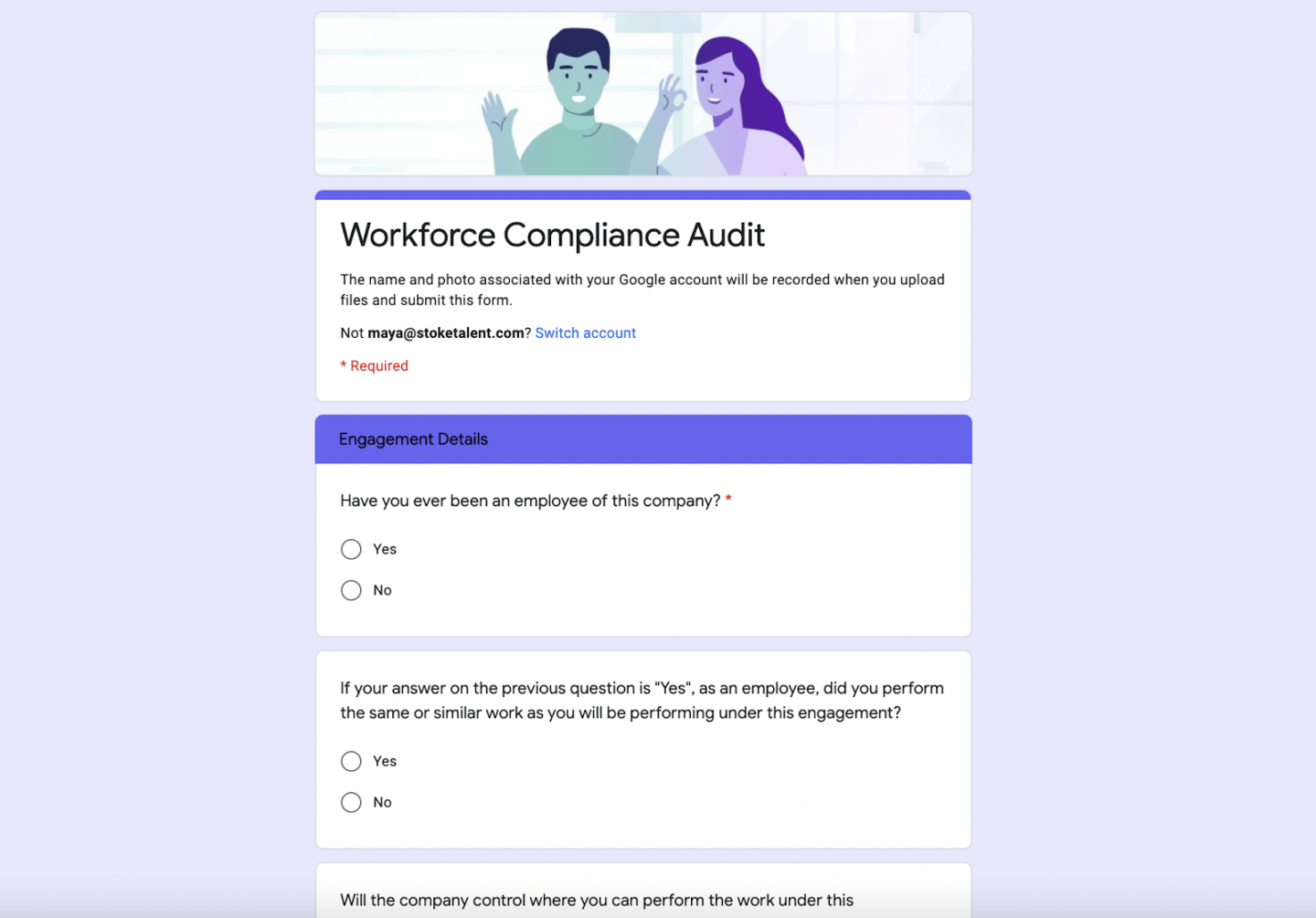

This means that two detailed questionnaires will be sent. One to the contractor and a second to the hiring manager, responsible for approving the contractor’s invoices. The goal will be to gather additional information such as: engagement type, control over work, was there a similar service provided to other companies, company equipment used etc. to help the engine establish the precise risk level and suggest actionable next steps to reduce the risk level.

#4 Detailed Report

The questionnaire results will then be analyzed as well as cross referenced with federal and state records to establish risk.

At the end of the process the system produces a detailed analysis report, updates contractor status on Fiverr Enterprise’s UI and sends out notification to the hiring manager and the relevant admins.

The report will include the following information: risk by juristrication, suggested actionable steps to reduce risk, summary of independent contractor laws and the transcript of the questionnaires.

The workforce is changing. Are you ready?

Companies rely more on non-payroll workers, and in a few years they will make up the larger share of the workforce.

Therefore companies need to ensure they have the required processes and tools to manage their contractors, including the ability to properly, accurately and continuously classify their non-payroll workers.

As long as the standards of worker classification are ambiguous, and the legal and business implications of misclassifying workers are high.

The risk of employee misclassification is further complicated by the fact that the legal requirements about worker misclassification are in flux, and the legal and business implications of misclassification are high.

Both state and federal governments are actively addressing the issue with new and changing standards. They’re also focused on increasing enforcement.

Thus, companies working with independent contractors have a heightened responsibility to ensure there’s no ambiguity in the work relationship. The potential financial costs of a government agency retroactively redefining it as an employer-employee relationship are too high.

One issue that is certain is that how a company works with an independent contractor is more important than contract language stating the worker isn’t an employee. Thus, using processes and platforms that show evidence of the worker’s autonomy are critical to protecting the company.

See Additional Guides on Key Compliance Management Topics

Together with our content partners, we have authored in-depth guides on several other topics that can also be useful as you explore the world of compliance management.

PCI Compliance

Authored by Exabeam

- PCI Compliance: The 12 Requirements and Compliance Checklist

- PCI Security: 7 Steps to Becoming PCI Compliant

- Quick PCI Compliance Checklist: Be Ready for Your Next Audit

1099 Employee

Authored by Fiverr

- 1099 Vs. W-2 : What’s The Difference?

- 1099 Rules for Employers: What Do I Need to Know About Working with 1099 Employees?

Independent Contractor Taxes

Authored by Fiverr

- 1099 NEC vs 1099 Misc: What’s The Difference?

- Do You Know Your New 1099 K Requirements for 2023?

- Step by Step 1099 NEC Instructions for Reporting Payments

Related content: Read our guide to independent contractor misclassification

Related content: Read our guide to employee classification examples

Thanks for sharing such a great information.. It really helpful to me..I always search to read the quality content and finally i found this in you post. keep it up!