It was never a matter of if, but when.

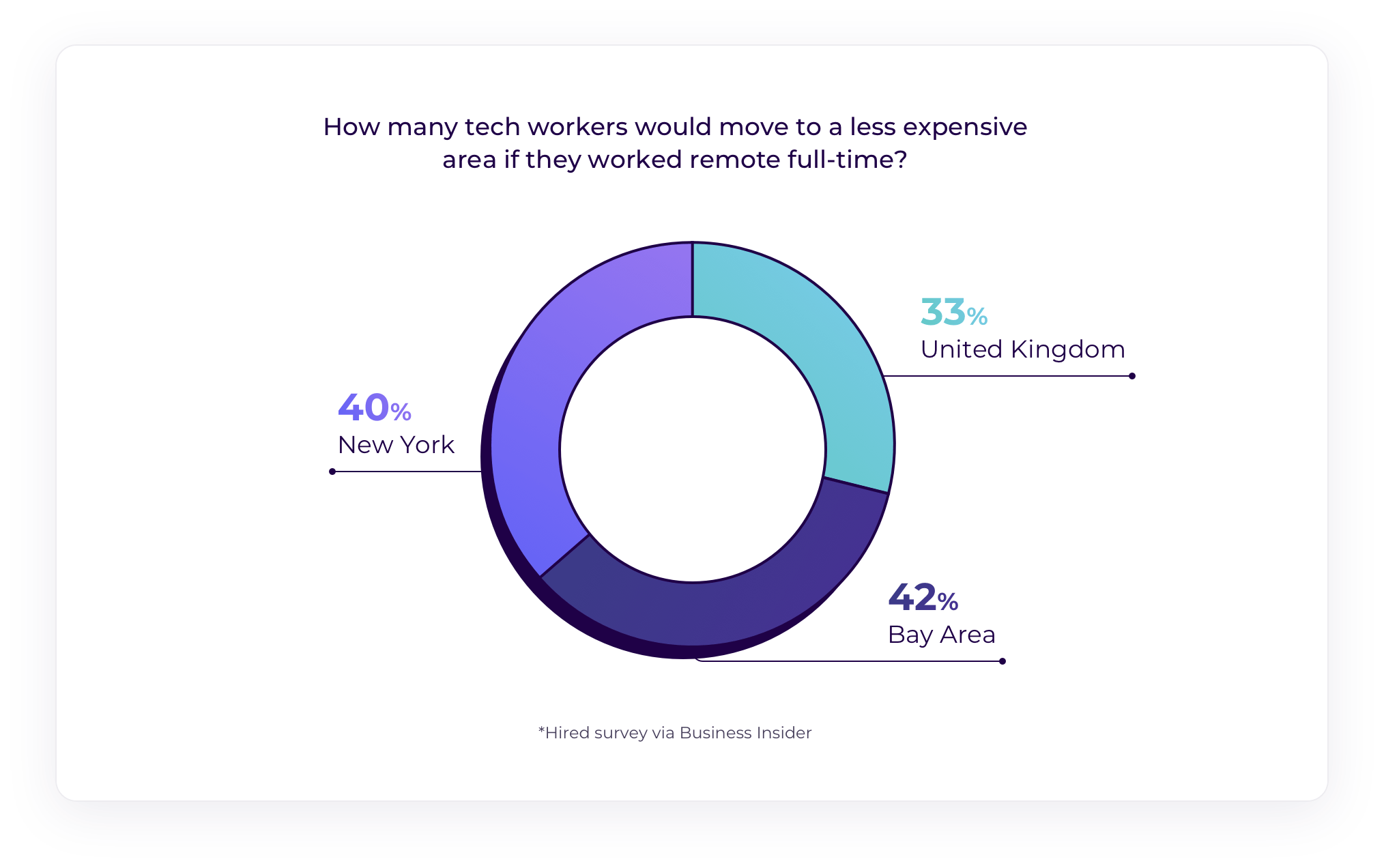

Experts have long discussed the possibility of a “tech exodus” from Silicon Valley due to the exorbitant cost of living. Now, new pressure from COVID-19 has expedited this mass exodus — and not just from Silicon Valley. With a number of tech employees now working fully remote, those in major cities all over the world are itching to vacate expensive urban centers for the greener pastures of lower-cost areas.

But it’s not just tech experiencing these tectonic shifts. A recent CNBC survey revealed that a majority of workers in several other industries have been doing their jobs remotely due to the COVID-19 outbreak, including:

- Consulting and research (85%)

- Insurance (84%)

- Advertising and marketing (73%)

- Finance and financial services (70%)

- Legal (68%)

The other finding? Most of the workers surveyed reported they’d like to continue working at home all the time — or at least more often than before the pandemic — even when it’s safe to go back to the office. Only 7% of those who responded said they wanted to go back into work five days a week.

These surveys show a clear and growing trend: almost no one wants to spend Monday through Friday in a brick-and-mortar office. Some companies have already begun working to reconcile this new normal — but is your organization ready for this shift?

1099 Workers: A Solution to Shifting to Remote Work

In response to a growing number of permanent remote roles, major tech companies like Facebook and VMware have chosen to deal with this mass exodus adopting “localized compensation” strategy — i.e., reducing salaries for employees who choose to move out of the area and work from home permanently.

The thing is, these approaches aren’t easy or clear-cut, can be cost-prohibitive, and they can land an organization in legal hot water if not executed precisely.

“The twist is that state laws are, quite literally, all over the map, writes Andi Smiles of Gusto. “That means you need to read up on the state legislation for employees working in another state.”

If you have employees working full-time in multiple states, you’ll need to ensure they’re adhering to both federal regulations, as well as state tax and legal regulations, including:

- Which legal entity to pay from

- Which types of contracts are required for employees (such as NDAs)

- Benefits required by law in the state where the employee is working

What’s more, the adoption of localized compensation — heaped on a growing pile of ethical bones to pick between tech workers and their organizations — has, unsurprisingly, led to backlash.

For the vast majority of organizations that don’t have Facebook-level resources (which is most of us), a safer and easier way to rebuild the ability to execute post-COVID is to shift to a mixed workforce with more 1099 employees.

For one, you don’t have to worry about figuring out multiple states’ benefits laws and policies. For another, 1099 workers are generally easier to pay since you don’t have to worry about state payroll taxes. And with global benefits like flexibility, instant access to subject matter experts, cost-savings, agility, higher satisfaction and engagement among freelancers, and even increased productivity, what’s not to love?

Shifting to a 1099 Workforce: What You Need to Know

When it comes to the shifting to remote work trend, it’s important to be realistic about whether your current internal processes are ready to handle such a shift — and what you’ll need to do to get them there if they’re not.

First, let’s think about financials and administration. Paying freelancers involves different rules and processes than paying full-time employees. When considering transitioning to a greater number of on-demand workers, it’s important to ask:

- Can you assure you easily send 1099 and 1042s to all your non-payroll workforce?

- Do you have clear control and visibility over your budget?

- How difficult is it for you to pay cross-border freelancers?

- Do you know how many freelancers are working for you today?

- Are you sure they are all compliant in their respective states?

- Do you manage all of that with Excel spreadsheets, or do you have a formal centralized platform or system in place?

You’ll also want to consider which of your internal processes are amenable to recruiting, hiring and training freelancers, and which ones will need some work. Remember, when it comes to hiring and managing remote workers, the responsibility falls largely on the hiring manager — not HR. So it’s important to consider questions like:

- Do you have an effective freelancer hiring process in place?

- How quickly can your managers onboard freelancers and pay them?

Knowing where your current processes measure up — and where they fall short — enables you to optimize where needed, so you can experience the full benefits of a mixed workforce more quickly.

Reap the Benefits of an Optimized Freelancer Hiring and Management Process

With remote work becoming a necessity overnight — and gaining massive appeal almost as quickly — there are more than a few upsides that come with ensuring your organization is ready to handle the sea change. Here are a few places to get started:

- Distribute, track and collect the right paperwork, set up a compliant recruiting process, access a pool of skilled on-demand workers, and maintain accurate records of your payments with the help of a platform like Fiverr Enterprise.

- Make sure your relationship with a new employee fits that of an “independent contractor” as described by the IRS.

- Take a look at the Society for Human Resource Management’s (SHRM) guidelines for how to maintain independent contractor status.

While the risks of working with out-of-state 1099 employees are much lower, it’s important to do your due diligence in ensuring your organization is compliant and maximizing all the right processes.

Ready to learn more? Visit Fiverr Enterprise’s blog to unlock more insights about the on-demand workforce, or get a guided tour of Fiverr Enterprise in action with one of our solutions experts.